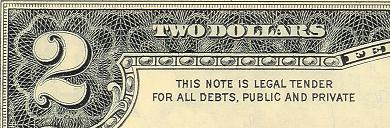

The Jeffersonian Cyclopedia is a collection of Thomas Jefferson’s writings. In this letter on public debt, Jefferson recognized that the dollar bill is an I. O. U., not actual capital. This fact seems to have faded in the minds of the gulls, as Jefferson puts it, despite a clear statement to that effect on every dollar bill.

In modern terms, the Federal Reserve Bank decides on a dollar amount that it needs to borrow to stimulate the growth of new businesses or to fund a war, then it prints dollars to symbolize the debt. When you and I then borrow the dollars, we take on a portion of the Fed’s debt. Once we own the dollar bills, we pay interest on the dollars that the Fed borrowed. The Fed borrows not just interest-free, but at a profit.

Can you imagine lending somebody money, then paying them a small sum every day to thank them for borrowing from you? I wish the credit card companies did that!

In addition, Jefferson points out that the dollar bills, the debt, are not actual capital. As symbols of the Fed’s debt, dollar bills make a convenient medium of exchange. But they have no intrinsic value, not the way a gold coin does.

He also hints at inflation as being tied to the rate of interest being charged on the public debt.

I’ve split it into paragraphs for readability, with interesting sections highlighted. The whole damn quote should be highlighted. It should be required reading for anyone who uses money.

Jefferson, Thomas, 1743-1826.

The Jeffersonian Cyclopedia

Thomas Jefferson Collection

Electronic Text Center, University of Virginia Library

——————————————————————–2013. DEBT, Public. —

At the time we were funding our national debt, we heard much about “a public debt being a public blessing”; that the stock representing it was a creation of active capital for the aliment of commerce, manufactures and agriculture. This paradox was well adapted to the minds of believers in dreams, and the gulls of that size entered bonâ fide into it.

But the art and mystery of banks is a wonderful improvement on that. It is established on the principle that “private debts are a public blessing”; that the evidences of those private debts, called bank notes, become active capital, and aliment the whole commerce, manufactures, and agriculture of the United States. Here are a set of people, for instance, who have bestowed on us the great blessing of running in our debt about two hundred millions of dollars, without our knowing who they are, where they are, or want property they have to pay this debt when called on; nay, who have made us so sensible of the blessings of letting them run in our debt, that we have exempted them by law from the repayment of these debts beyond a given proportion (generally estimated at one-third). And to fill up the measure of blessing, instead of paying, they receive an interest on what they owe from those to whom they owe; for all the notes, or evidences of what they owe, which we see in circulation, have been lent to somebody on an interest which is levied again on us through the medium of commerce. And they are so ready still to deal out their liberalities to us, that they are now willing to let themselves run in our debt ninety millions more, on our paying them the same premium of six or eight per cent. interest, and on the same legal exemption from the repayment of more than thirty millions of the debt when it shall be called for.

But let us look at this principle in its original form, and its copy will then be equally understood. “A public debt is a public blessing.” That our debt was juggled from forty-three to eighty millions, and funded at that amount, according to this opinion a great public blessing, because the evidences of it could be vested in commerce, and thus converted into active capital, and then the more the debt was made to be, the more active capital was created. That is to say, the creditors could now employ in commerce the money due them from the public, and make from it an annual profit of five per cent., or four millions of dollars.

But observe, that the public were at the same time paying on it an interest of exactly the same amount of four millions of dollars. Where, then, is the gain to either party, which makes it a public blessing? There is no change in the state of things, but of persons only. A has a debt due to him from the public, of which he holds their certificate as evidence, and on which he is receiving an annual interest. He wishes, however, to have the money itself, and to go into business with it. B has an equal sum of money in business, but wishes now to retire, and live on the interest. He therefore gives it to A in exchange for A’s certificates of public stock. Now, then, A has the money to employ in business, which B so employed before. B has the money on interest to live on, which A lived on before; and the public pays the interest to B which they paid to A before. Here is no new creation of capital, no additional money employed, nor even a change in the employment of a single dollar. The only change is of place between A and B in which we discover no creation of capital, nor public blessing.

Suppose, again, the public to owe nothing. Then A not having lent his money to the public, would be in possession of it himself, and would go into business without the previous operation of selling stock. Here, again, the same quantity of capital is employed as in the former case, though no public debt exists. In neither case is there any creation of active capital, nor other difference than that there is a public debt in the first case, and none in the last; and we may safely ask which of the two situations is most truly a public blessing?

If, then, a public debt be no public blessing, we may pronounce, à fortiori, that a private one cannot be so. If the debt which the banking companies owe be a blessing to anybody, it is to themselves alone, who are realizing a solid interest of eight or ten per cent. on it.

As to the public, these companies have banished all our gold and silver medium, which, before their institution, we had without interest, which never could have perished in our hands, and would have been our salvation now in the hour of war; instead of which they have given us two hundred million of froth and bubble, on which we are to pay them heavy interest, until it shall vanish into air as the Morris notes did.

We are warranted, then, in affirming that this parody on the principle of “a public debt being a public blessing,” and its mutation into the blessing of private instead of public debts, is as ridiculous as the original principle itself. In both cases, the truth is, that capital May be produced by industry, and accumulated by economy; but jugglers only will propose to create it by legerdemain tricks with paper. —

TITLE: To J. W. Eppes.

EDITION: Washington ed. vi, 239.

EDITION: Ford ed., ix, 411.

PLACE: Monticello

DATE: Nov. 1813

Bad Behavior

Bad Behavior Member of American Mensa, Ltd.

Member of American Mensa, Ltd. Church of the Flying Spaghetti Monster

Church of the Flying Spaghetti Monster Potential Threat To The Nation

Potential Threat To The Nation Amazon.com Daily Deals

Amazon.com Daily Deals